About 30% of sector profitability is lost due to high costs and low digitalization. For example, depreciation for certain types of transport infrastructure takes from 40% to 100%, and the use of digital technologies is carried out in less than 10% of companies. As a result, the share of transportation costs can reach 40% of the final cost of goods delivered.

The geographical features of Kazakhstan – the location in the center of the Eurasian continent between the largest economically developed countries of Europe and Asia – create promising prerequisites for the development of the transport network. More than 23 million containers are transported annually between the two regional economies of the world. About 95% of them are delivered by sea, 4% – via railways, and the remaining 1% – via air links, highways and pipelines.

The territorial location of Kazakhstan is the potential of developed logistics

The expansion of railway transport flows from China and Southeast Asia to the countries of the European Union is important for Kazakhstan on the way to integrating the national economy into the global economic space. That is, the main factors that largely determine the development strategy of the Kazakhstan transport system are the benefits and advantages that the country can get due to its geographical location.

Today, six international transcontinental transit corridors connecting Europe and Asia run through Kazakhstan. In 2019, 3.1 thousand container trains passed along them along the route China – Europe – China, which delivered 347 thousand containers. This is 5% more than in 2018.

Moreover, trade and economic cooperation with the leading world markets of China and Europe has become more accessible for Kazakhstan through participation in the “Belt and Road” initiative. Its further conjugation with the Eurasian Economic Union will help lay the foundation for the formation of a new geopolitical contour in Eurasia. And Kazakhstan, with the created financial infrastructure – the Astana International Financial Centre – can become a regional hub for attracting investments and developing financial instruments.

For domestic entrepreneurs, the AIFC provides an opportunity to participate in the “Belt and Road” initiative, which gives them access to world markets, as well as attracting investments through the Astana International Exchange stock exchange.

It is expected that in the near five-year perspective, the increasing demand for electronic commerce will increase the number of parcels sent in transit through Kazakhstan by 6 times. In 2019, their number was about 40 million units. And by 2025 it can reach 240 million parcels, which will increase the profitability of Kazakhstan’s logistics companies by 1.3 trillion tenge per year.

Transport logistics forms 8.1% of national GDP

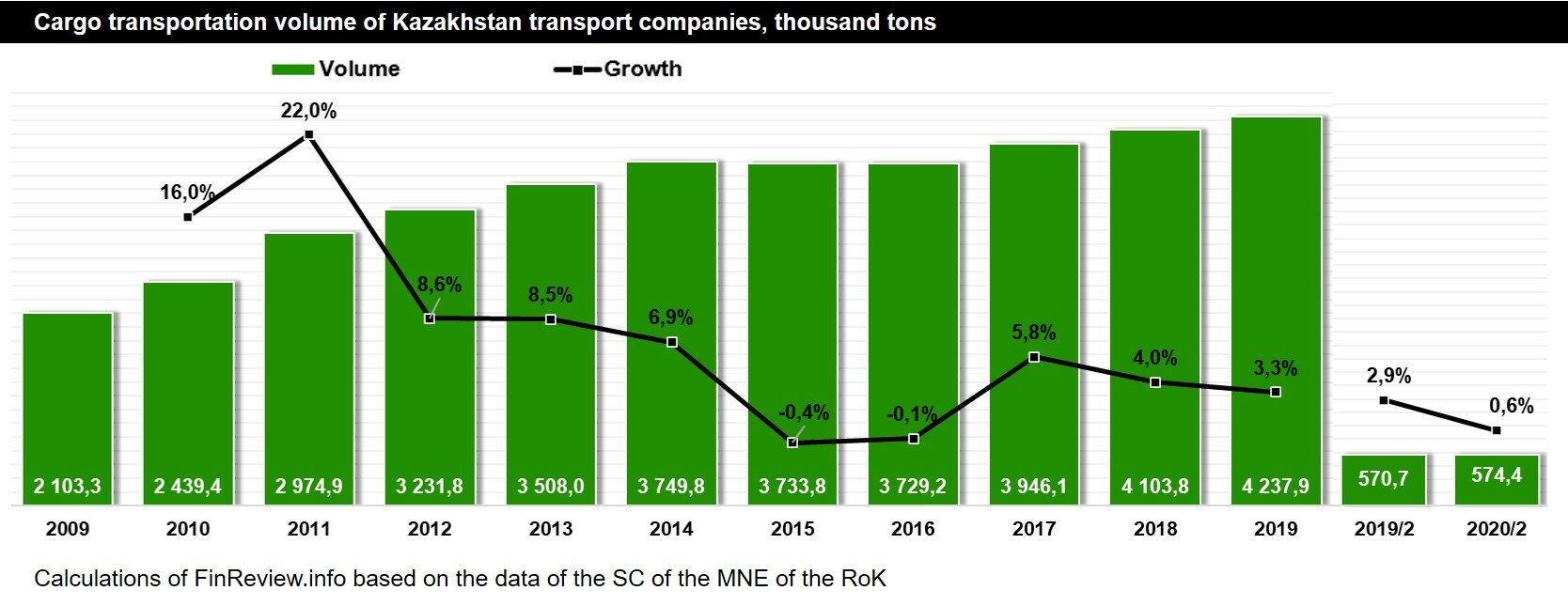

Over the past decade, Kazakhstan has managed to significantly improve the country’s transport and logistics network. Since 2009, the volume of cargo transportation has almost doubled, from 2.4 billion tons to 4.2 billion tons in 2019. The growth was due to the development of transport infrastructure, in which over $ 30 billion was invested over a decade. The influx of investments allowed us to reconstruct about 7 thousand km of motorways, which are the main type of transportation.

In 2020, according to the results of two months, the volume of cargo transportation by Kazakhstani enterprises reached 574.4 million tons, which practically coincides with the indicator for the same period in 2019. At the same time, lorries account for 80.6% of the delivered cargo. 10.9% of the cargo was delivered via trains, and the remaining 8.6% of the cargo via pipelines, ships and air transport.

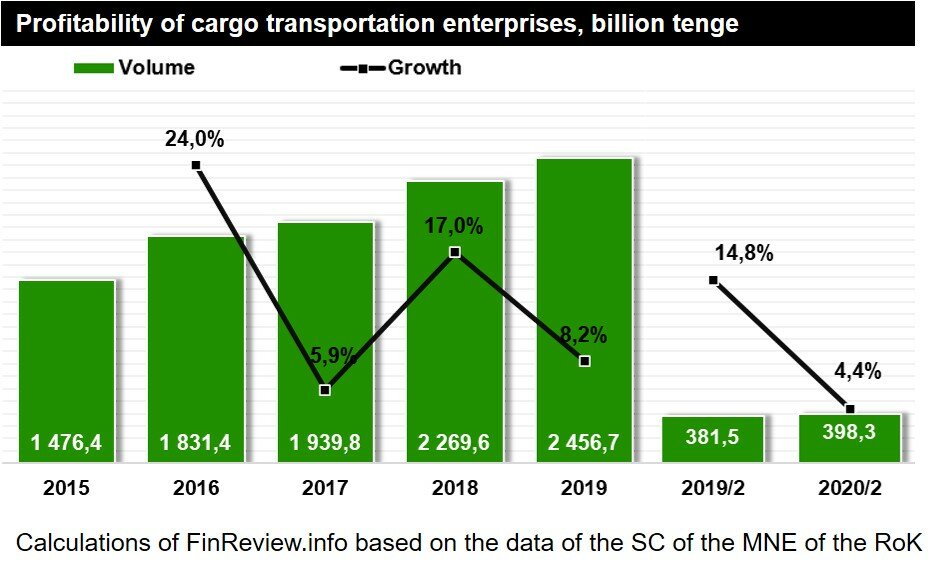

Nevertheless, profitability from road transport is much lower than from rail. So, despite the fact that the volume of road transport is 6 times higher than the volume of rail, the profitability from their transportation, on the contrary, is 10 times lower.

In total, transport companies earned 398.3 billion tenge in the two months of 2020. And gross output reached 1.2 trillion tenge. Over half of the regional GDP was generated by the cities of Almaty (162.5 billion tenge) and Nur-Sultan (134.4 billion tenge), as well as Atyrau (106.3 billion tenge), Almaty (86.5 billion tenge) and Zhambyl (78, 2 billion tenge) by regions.

Transport Issues

At the moment, two key problems of the transport sector can be distinguished:

The first is associated with high logistics costs, which are significantly higher than in developed countries. Thus, the share of transportation costs in Kazakhstan can reach 40% of the final cost of goods delivered, while the global average is 11% (in China – 14%, in the countries of the European Union – 11%, in the USA – 10%). This indicates a high depreciation of the transport infrastructure of Kazakhstan and the inefficiency of logistics processes due to the use of outdated technologies. For example, depreciation for certain types of transport infrastructure takes from 40% to 100%, which obviously affects the cost of transportation and higher prices for goods.

The second problematic issue concerns the low digitalization of the industry. For example, digital technologies are used only by 1% of transport companies, robotics – 2%, cloud IT services – 10%.

According to international experience, the introduction of digital technologies can reduce the cost of transportation of goods, which leads to an increase in the profitability of the sector and lower prices for goods, provides an increase in freight traffic with a better control mechanism, and simplifies the entry of companies into the world market.