But even in this situation, the accumulated international reserves of Kazakhstan will allow supporting the national economy for 15 years. That is, Kazakhstan has great potential to survive the current crisis with the least losses.

The oil and gas sector for the economy of Kazakhstan is a strategically important industry. The country has significant hydrocarbon resources – the total volume of oil reserves is about 30 billion barrels, or 1.7% of world reserves. According to this indicator, Kazakhstan is in the 12th position in the world, behind the countries of the Middle East, Latin America, as well as Russia and the USA.

With its high raw material potential, Kazakhstan is enhancing the contribution of the oil and gas sector to the development of the national economy. Over the past three years, a number of projects have been implemented to increase industrial production. Firstly, in 2017, new oil deposits were discovered at the Rozhkovskoye field in the West Kazakhstan region. Secondly, the Zharkum field was commissioned, which for almost three decades will be able to supply gas to the Zhambyl region, reducing the dependence of the southern regions of the country on imports from Uzbekistan. Thirdly, in 2018, the modernization of the largest refineries in Atyrau and Pavlodar regions, as well as the city of Shymkent, was completed.

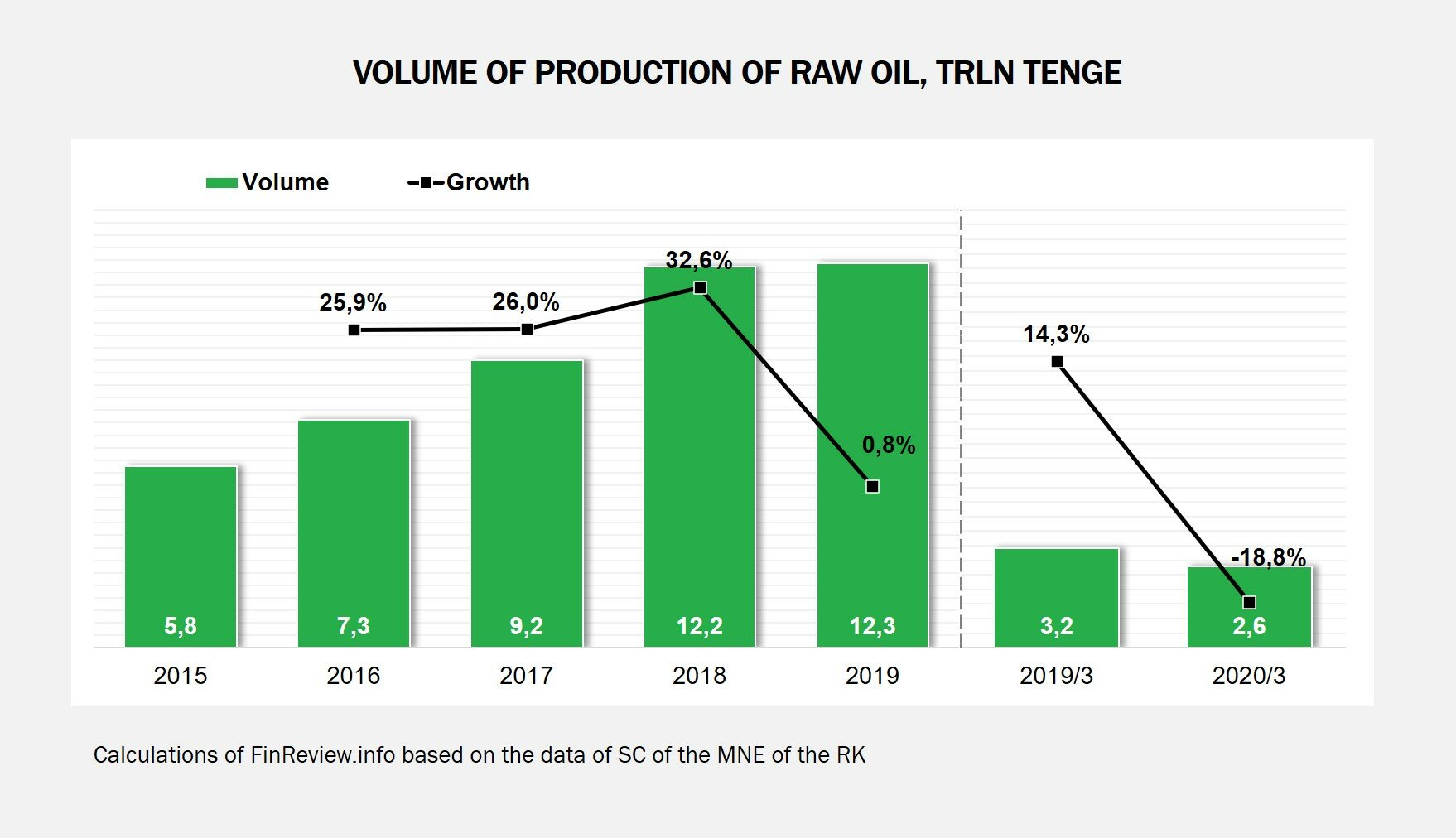

The economic effect of these projects became noticeable in 2019. So, oil production increased by 33% compared to 2017, reaching 90.5 million tons, and in monetary terms – 12.3 trillion tenge. This made it possible to strengthen the sector’s contribution to the country’s GDP from 13.6% to 14.4%, provide the budget with tax revenues and payments by 44% and fully cover the domestic market with its own fuel.

However, since the beginning of 2020, global oil demand has declined by almost 20 million barrels per day, and its cost by 70%

2020 brought new challenges to the global economy – the coronavirus pandemic, which is actively spreading around the world, has reduced industrial production, which has led to a decrease in oil demand. In the first two months, the virus began to spread in China, which is the second largest global consumer after the United States, which led to a decrease in their economic activity. During this period, the price of Brent crude oil decreased by about 20%, to 55 US dollars per barrel.

But the collapse of oil prices occurred later – at the end of the first decade of March – as a result of the fact that Russia and Saudi Arabia could not agree on a new reduction in hydrocarbon production within OPEC +. This hit the market harder – quotes for Brent crude futures per barrel fell below 30 US dollars.

The OPEC + agreement would help reduce the surplus of oil in the market caused by a drop in demand by almost 20 million barrels per day, and as a result stabilize prices. However, for a whole month while the hydrocarbon exporting countries were negotiating, the excess of oil on the world market continued to grow. According to preliminary estimates, its figure in the second quarter of 2020 may reach about 14.7 million barrels per day.

Even the agreements reached on April 12 under OPEC + to reduce oil production by 9.7 million barrels per day will not block such a daily surplus. As a result, the average oil price in 2020, according to IMF estimates, will be 34.8 US dollars per barrel (current price is 19.82 US dollars per barrel as of 23:30 Moscow time on April 21).

Despite this, in the first quarter of 2020, Kazakhstan increased its oil production by 2.4%, and its transportation – by 5%

A decrease in global oil demand and a drop in its value have a noticeable effect on the economy of Kazakhstan due to the country’s continuing raw material dependence. Over the past two years, oil has provided revenues to the Kazakh budget at more than 1 trillion tenge. If the value drops to 25 US dollars, the export customs duty will reach zero and the revenues from oil companies will also be reset to zero.

At the same time, in January, revenues from oil and natural gas exports fell by 900 million US dollars. For example, only France, Switzerland and Italy reduced imports of Kazakhstani oil by 863 million US dollars.

However, despite the decline in global demand, the statistics of industrial production in Kazakhstan for the three months of 2020 shows an increase in oil production by 2.4% compared to 2019. The volume of its production amounted to 23.6 million tons, and in monetary terms – 2.6 trillion tenge. At the same time, if oil production did not change in January, then in February it grew by 4.3%, and in March – by 3.3%.

Kazakhstan also managed to increase the volume of oil transportation by 5%. Through the Caspian Pipeline Consortium – the largest international channel – 16.9 million tons of oil were exported.

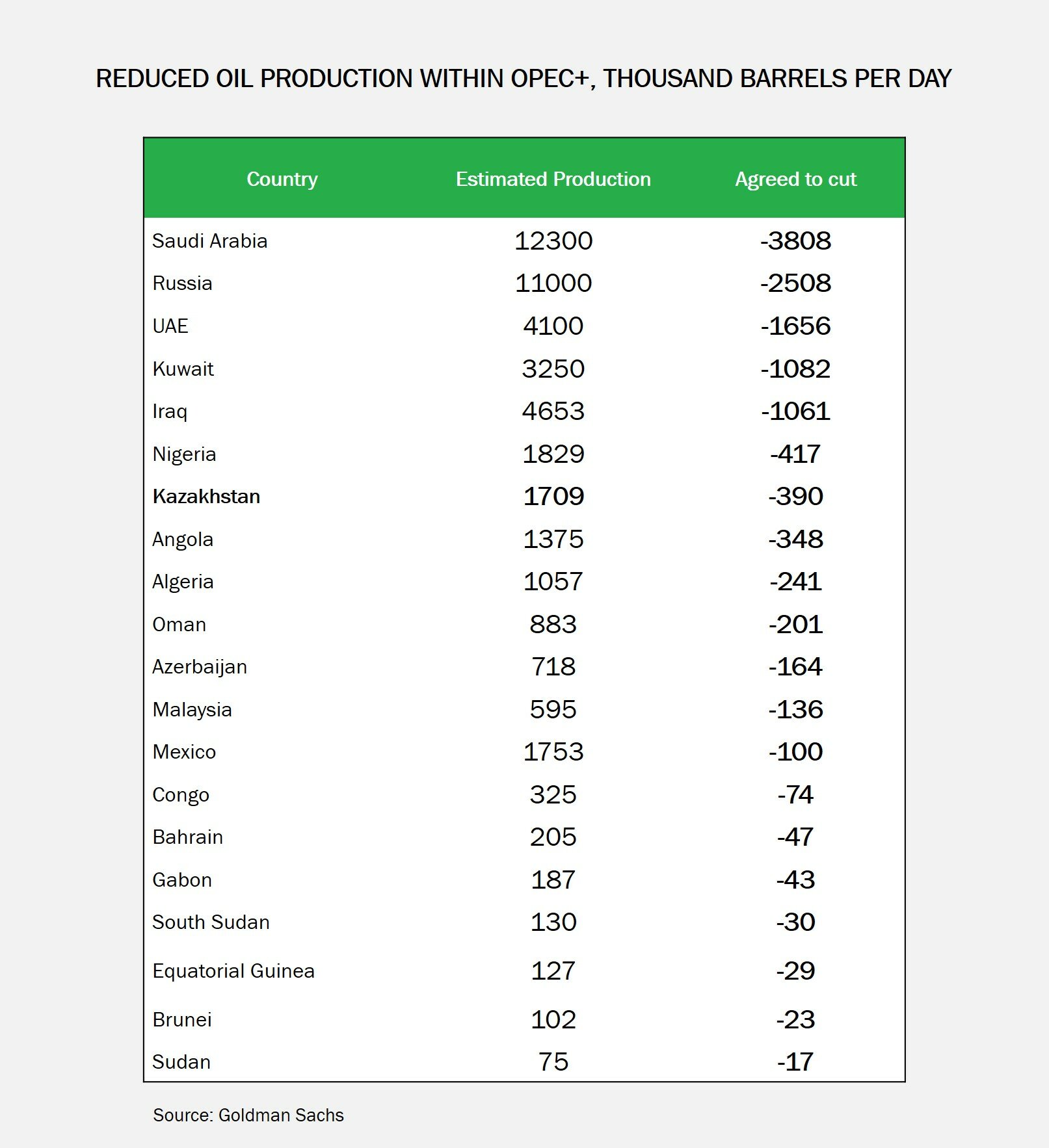

However, on May 1, the agreement of the OPEC + oil exporting countries comes into force, within the framework of which Kazakhstan is committed to reduce production by 390 thousand barrels per day. This reduction was determined from the base level for October 2018, when production was 1.7 million barrels per day, although at the end of December 2019 it was increased to 1.9 million barrels per day. That is, in fact, the reduction will be much more voiced plans.

The need for this agreement is obvious – this is a decrease in oil overstock at storage facilities, which will ensure stabilization of its value. If oil consumption does not recover and does not show a positive trend, then low prices will continue. At current prices, the annual decline in Kazakhstan’s GDP will be from 2.3% to 2.7% of GDP.

What problems will Kazakhstan face with long-term maintenance of current oil prices?

The first and most basic problem is the shortage of cash receipts to the state budget. This will lead to lower funding for social programs, production development programs, higher inflation and lower living standards.

The second problem is associated with a decrease in financing for the oil industry and the development of new fields. Now, the average cost of oil reaches about 46 US dollars per barrel, while in some fields the cost is 20 US dollars, and in others – 60 US dollars.

The third problem is the upcoming suspension of oil companies. A decrease in demand and a drop in the cost of oil may lead to a suspension of production at some fields, where the cost is much higher than the market price. Such deposits will not be closed because the resumption of work will bring more costs to the company. However, such a pause will create financial risks and lead to a reduction in the number of employees.

The fourth problem is caused by a decrease in investment income in the sector. Already in 2019, there was a decrease in quarterly volumes of foreign direct investment from 1.8 billion US dollars in the 1st quarter to 643 million US dollars in the 4th quarter. This year the situation has become more aggravated due to a decrease in demand for oil and oil products. But Kazakhstan has a definite advantage in the form of financial institutions that can help enterprises attract additional capital. Such institutions include the Eurasian Development Bank, the European Bank for Reconstruction and Development, the Astana International Financial Centre, the Development Bank of Kazakhstan, BCC Invest, KazakhExport, Kazyna Capital Management, etc.

Nevertheless, it is now difficult to assess what the cost of oil will be in the near future. Market forecasts are very different. For example, the Fitch Ratings international agency estimates that the average oil price will be 41 US dollars per barrel, and the IMF forecast is 34.8 US dollars. Obviously, after the planned reduction within OPEC +, the market situation will be more clear.

However, even in the case of a long-term preservation of the cost of oil at about 20 US dollars per barrel and the current economic situation in the country, Kazakhstan will be able to maintain the national economy for 15 years, thanks to the accumulated international reserves, which amount to about 30 billion US dollars. That is, Kazakhstan has great potential to survive the current crisis with the least losses.