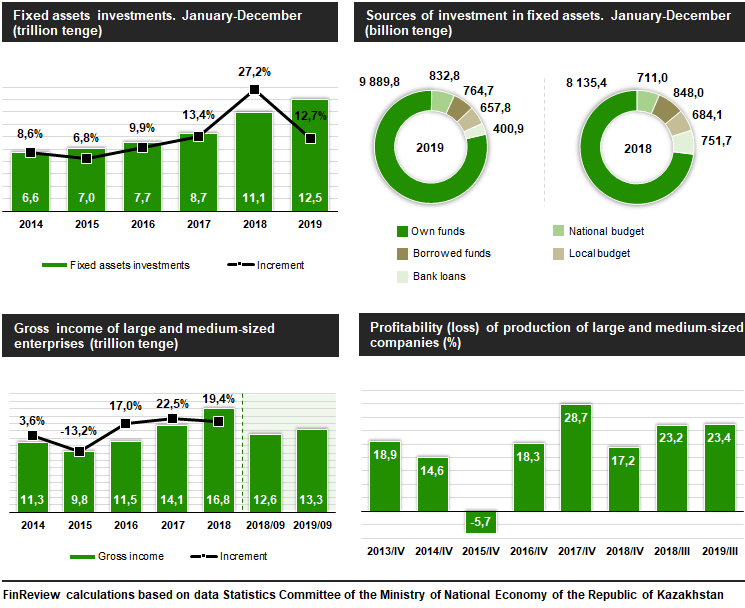

Investments in the fixed assets maintained the upward trend – in 2019, their volume increased by 12.7% and reached 12.5 trillion tenge. At the same time, the enterprises strengthened their financial stability, which allowed reducing the share of state participation in project financing.

In a globalized world economy, investment plays a key role being a prerequisite for the effective development of economic sectors, the stable functioning of basic infrastructure, and the achievement of sustainable economic growth. In Kazakhstan, over the past five years, investment policy has ensured an average annual growth of 14% in fixed assets investment.

In 2019, the volume of investments in fixed assets reached 12.5 trillion tenge, having increased by 1.4 trillion tenge compared to 2018. In retrospect of the last five years, there is a dynamic growth in fixed capital financing – in 2014, their volume amounted to 7 trillion tenge.

The growth of investment flows positively affected an increase in corporate profits. Thus, according to the results of nine months of 2019, large and medium companies recorded a gross profit of 13.3 trillion tenge. At the same time, in 2018, the index amounted to 12.6 trillion tenge.

The growth of corporate income and the transformation of savings into investment lead to an increase in investment potential of Kazakhstan, and as a result, to accelerated economic growth. That is, an increase in corporate income provides high rates of capital accumulation, which in turn affects the growth of labor productivity, and as a result, leads to faster GDP growth.

Thus, the current statistics of enterprises demonstrates strengthening of their financial stability – 78.8% (or 9.9 trillion tenge) of investment flows are formed at the expense of own funds. For comparison, in 2014, own investments accounted for 57.9% of the total volume of investments.

The increase in the equity share in project financing is observed against the low popularity of bank lending and loans. Taken together, these financing instruments accounted for only 9.3% of the total volume of investments. In monetary terms, borrowings accounted for 400.9 billion tenge and loans – for 764.7 billion tenge.

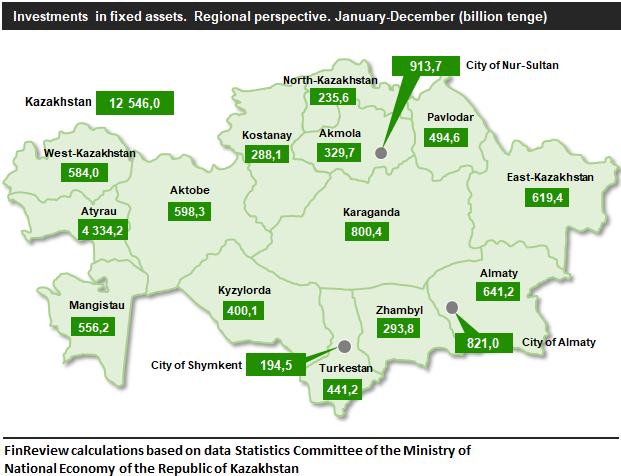

Regionally, the most investment-intensive enterprises are in Atyrau region, where the volume of additional capitalization in 2019 amounted to 4.3 trillion tenge, which is 17.5% more than in the same period in 2018. Next come the cities of Nur-Sultan with the volume of investments in fixed capital of 913.7 billion tenge (-13.5%) and Almaty – 821 billion tenge (+12.2%).

Karaganda region (+70.4%), Turkestan region (+53.2%) and West-Kazakhstan region (+28.9%) showed the largest growth in investment. While the smallest volume of investments is observed in the enterprises of the city of Shymkent – 194.5 billion tenge, North-Kazakhstan region – 235.6 billion tenge and Kostanay region – 288.1 billion tenge.

Investments in the fixed assets allow increasing the level of labor productivity and the gross regional product. Thus, for nine months of 2019, the largest contribution to the GDP of the country was made by enterprises of the city of Almaty – 8.2 trillion tenge (or 18.5% of GDP), Atyrau region – 5.8 trillion tenge (or 13%) and the city of Nur-Sultan – 4.6 trillion tenge (or 10.3%). Moreover, the largest GRP growth was observed in East Kazakhstan region (9%), Atyrau region (8.8%) and the city of Nur-Sultan (7.2%).

Positive contribution of investments in fixed assets to the country’s economy has been lasting for 6 years. As a rule, the maximum effect takes place in the second quarter consisting in the increase of gross output by 0.07 percentage points, while in a year the accumulated effect may reach 0.10 percentage points.

One of the main objectives of investments in fixed assets is the renewal of fixed assets (buildings, structures, equipment, vehicles, computer and software, high technology industrial technologies, etc.). Usually renewals are required every 7-8 years; otherwise, outdated assets lose their competitiveness, thus slowing down the economic development of enterprises. In Kazakhstan, the assets have been actively renewed in recent years. While in 2014, the degree of depreciation of fixed assets was 43.7%, in 2018, it was 35.7%. In turn, in 2019, the volume of work on construction and overhaul of buildings and structures increased by 17.9% during the year and amounted to 6 trillion tenge, while investments aimed at renewal and overhaul of machinery, equipment, vehicles and tools increased by 8.6%, reaching 3.7 trillion tenge.

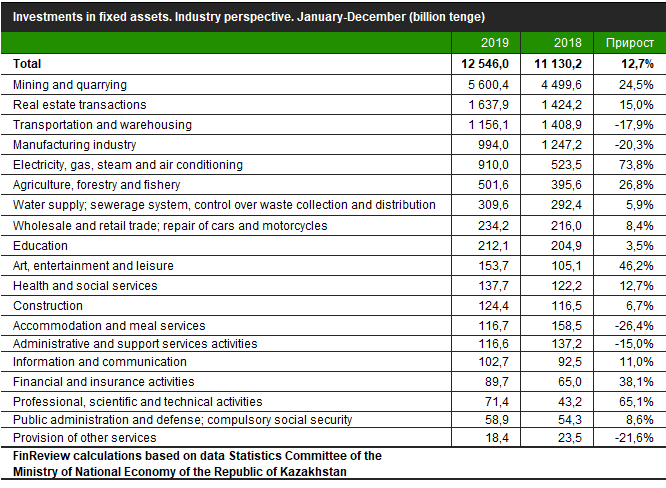

The most investment attractive sector of the economy is mining sector – the volume of investments here reached 5.6 trillion tenge, which is 24.5% more than in 2018 (4.5 trillion tenge). Also attractive by the volume of investments are real estate operations (1.6 trillion tenge), transport and storage (1.2 trillion tenge), manufacturing industry (994 billion tenge), as well as electricity, gas, steam and air conditioning (910 billion tenge).

At the same time, investment flows in the manufacturing industry make it possible to accelerate the process of diversification of the national economy. The contribution of this sector to GDP is already about 12 per cent, and investment is stimulating sector development. Thus, since 2015, the country has launched more than 500 new projects of the Map of Industrial development with investments of about 5 trillion tenge. New projects have been launched in the agro-industrial complex and agricultural processing (156), construction materials production (152), mechanical engineering (59), mining and metallurgical complex (41), chemistry (31), light industry (22), oil refining (21), energy (15), pharmaceuticals (6) and other spheres. As a result, more than 80 thousand permanent jobs were created.

It should be noted that the Government of the Republic of Kazakhstan has set an objective to increase the volume of investments in fixed assets by 20% on average annually. To implement this objective, the enterprises of Kazakhstan need to attract about 30 trillion tenge within the next five years, taking into account already formed projects for a total amount of 12.4 trillion tenge.

However, most sectors of the economy lack funds to finance investment projects. The lack of funds slows down the pace of development of the national economy and prevents Kazakhstan from integrating into global investment flows. This challenge can be met by using the stock market potential.

The AIFC’s Astana International Exchange (AIX) operates in Kazakhstan, the potential of which in the near future may play a key role in solving the problem on development and modernization of national production. The exchange’s capabilities will allow enterprises to attract additional capital including innovations, business solutions and professional staff.