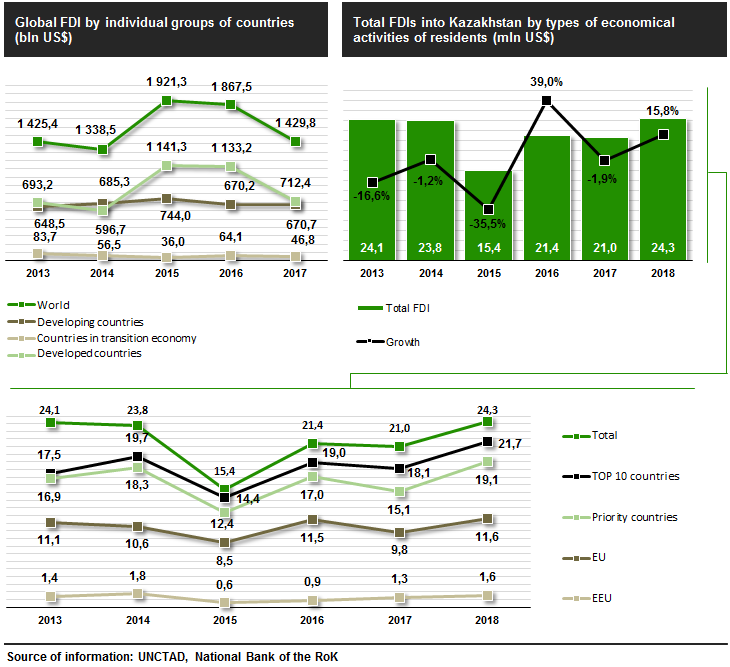

The global crisis of 2015 significantly reduced dynamics of international investment flows into developed countries and countries in transition. As for Kazakhstan it is vice versa, since 2015, the inflow of investments has dramatically increased and by the end of 2018, the growth was 58% from 15.4 to 24.3 billion USD. Big investing countries are the Netherlands, USA, and Switzerland. Investments were mainly made into mining, processing industries, professional, scientific, technical activities, transportation and warehousing, finance and insurance sectors of economy.

Growing globalization processes have been stimulating countries to an integrated cooperation within economic alliances. Regional integration of economies with similar level of the development, the rate of growth and potential can contribute to more effective involvement into the world market-based economy.

During the last two years the world investment flows after the rapid growth in 2015 by 43.5% at 1.9 trillion US$, have demonstrated a decreasing dynamics. At the end of 2017 the total global investment volume was 1.4 trillion US$ (-23.4%). There was noted a rise by 0.1% at 670.7 US$ bln only in developing states out of general category of countries. FDI of developing states reduced significantly by 37.1% and of economies in transition by 27.1%. Thus, the global investment flow tends to remain as moderately negative but with the perspective of its recovery to the Y2015 level.

As per IMF and The World Bank’s rating Kazakhstan is a developing country. According to Y2018 results the volume of international investments into the country increased by 15.8% during the year and reached its record value for the last five years at 24.3 US$ bln. The increase in comparison with the crisis year in 2015 made up 58% or 8.9 US$ bln. In its turn, the national economy has been developing more regularly and demonstrates a positive dynamics each and every year. FDI’s involvement into Kazakhstan’s economy is at 14% and it is planned to increase it up to 19% by Y2022.

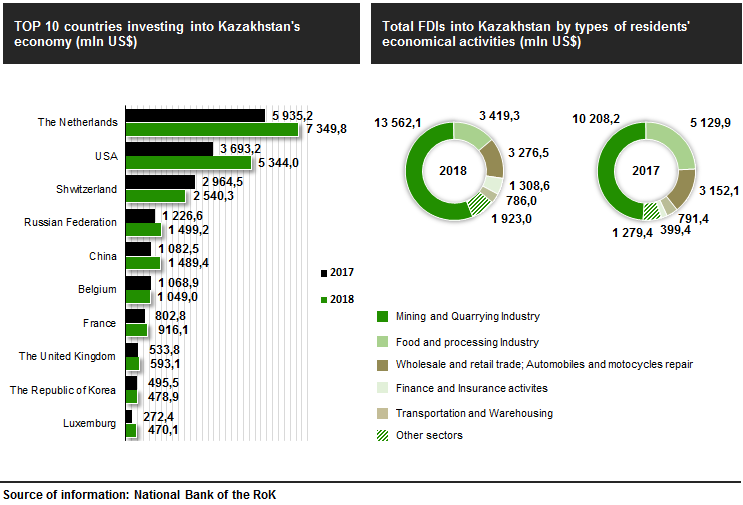

Prevalently representatives of developed countries are big investors of the Kazakhstani economy. Key investors are the Netherlands (7.3 US$ bln), USA (5.3 US$ bln) and Switzerland (2.5 US$ bln). Russia is on the fourth place with the investment volume at 1.5 US$ bln. TOP 10 investing economies have ramped up their investments into Kazakhstan’s economy by 20.2% during the year. It is noteworthy that the first ten investing countries have concentrated 89.5% of total FDIs in Kazakhstan.

Investments are directed onto a fairly narrow list of industries. Traditionally most attractive for the investments is mining and quarrying industry. By the end of 2018 there were invested in total 122.1 US$ bln into the industry (55.7% of all investments made). Professional, scientific and technical activities is the next sector highly demanded by international investors. The investments volume into this sector was at 16.9 US$ bln (7.7% of all investments made). Other five lead sectors are processing industry (16.8 US$ bln), transportation and warehousing (14.4 US$), finance and insurance business (13.4 US$ bln). Total volume of investments accumulated at the listed industries, made up 183.6 US $ bln or 83.7%.

Apart from the investment leaders a number of high priority countries and industries were identified within the frames of National Investment Strategy . Total list consists of 19 states that include representatives of EEU, EU, OECD, Middle East and Asia.

Two main outlined groups of the industries are:

• Group I — «industry with effective potential»: food, advanced petroleum, gas, and minerals refinery (metallurgy, chemical and petrochemical) and machine engineering industries. Group I consists of sectors where it is possible to attract FDIs focused on short and long term increase of the efficiency. Given industries are the source of Kazakhstan’s competitive advantage and attract FDIs.

• Group II — «perspective industries»: IT technologies, tourism and finance. This group consists of sectors capable to arouse interest of international investors in long term perspective and, as a result, raise export potential. For example, the development of internal and external tourism that heightens the country’s image or creates in the country a critical mass of highly qualified specialists in ICT sector – the worldwide top-priority sector.

The creation of special economic zones is another key factor of deepening the integration processes into the regional economy. As of today, there have been created and operating 12 free trade and 23 industrial zones in Kazakhstan. For their creation there have been allocated 314.3 bln US$ from the state budget and this allowed further to attract investments amounted at 910 bln US$.

Special legal status of the FTZs stipulates tax exemptions, various tax benefits, and simplified order to access land lots located at FTZ areas and to employ foreign workforce.

For participants of all FTZs the following preferences are provided:

• CIT exemption;

• land tax exemption;

• property tax exemption;

• VAT exemption when selling goods consumed in full at FTZ’s area during production process.

There are also other tax benefits for participants of “Innovative Technology Park” FTZ such as social tax exemption and exterritoriality. These preferences shall stimulate an active growth of external investment flows into the top priority sectors and improve Kazakhstan’s investment image.

Along with mentioned upgrading process, Astana International Finance Center (AIFC) that has become the regional financial center of EEU and Central Asia countries, holds a special place in the concept of economic growth. The creation of unified financial regulating authority for Eurasian Economic Union in Kazakhstan at relevant level of AIFC’s involvement shall speed up the integration of Kazakhstan by 2025 with Central Asia’s economics considering the interests of the national economy.

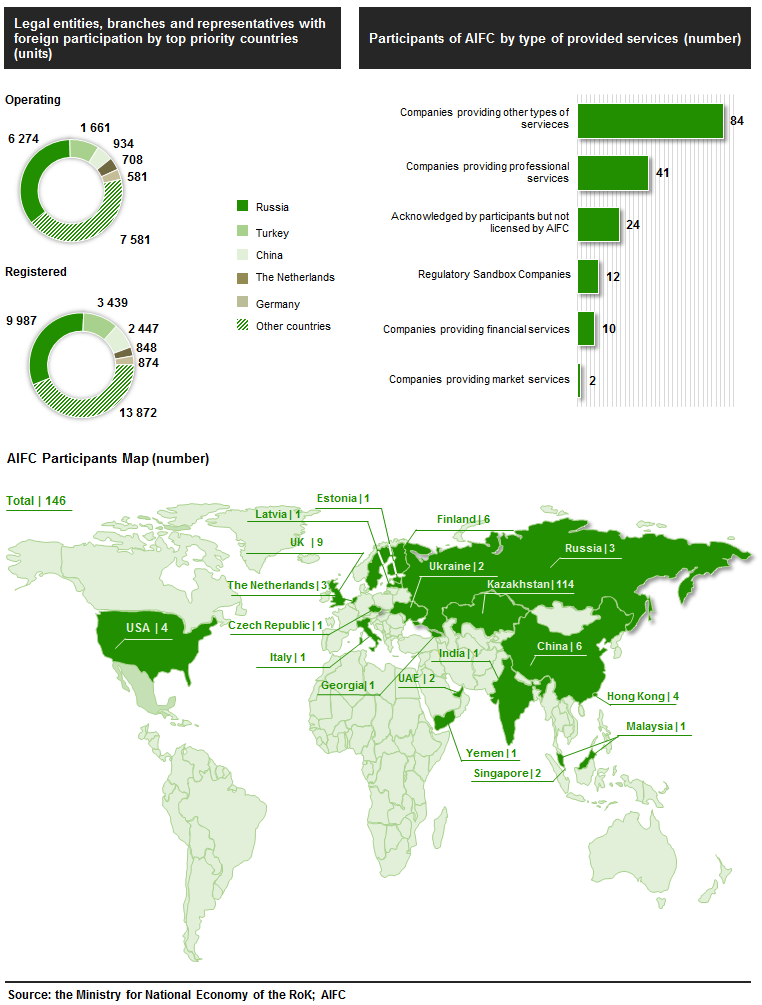

At the end of Y2018 there were registered 31.5 thousands of legal entities, branches and representatives with foreign participation, of them operating are 17.7 thousand organizations (56.4%). Working legal entities from Russia, Turkey and China dominate in Kazakhstan. Gross count of active companies from the three states makes up 15.9 thousands which is the half of the foreign companies’ market.

However, on July 2, 200 companies were registered on the basis of the AIFC. Among the participating companies are such world giants as China Construction Bank, China Development Bank, WOOD & CO, CURTIS MALLET-PREVOST (Qazaqstan) Limited, CICC, Lukoil, SWHY and others. Out of the international representatives registered in AIFC, majority are from the United Kingdom (9), Finland (6), China (6), Hongkong (4), USA (4), Russia (3) and the Netherland (3). Global reach of the registered companies clearly show a high interest of the international community in the financial center providing a wide range of opportunities and preferences to its participants. As the international experience of advanced financial centers from New York and London to Dubai, Hongkong and Singapore shows the centralization of finanical markets at one site and regulated by the special legal status gives a good impulse not only to representatives of the financial sector but to the economy, in general.